WeekWise XXI

#21 WW: SBF sentenced to 25 years, why do Governments always increase spending, and some facts about the aviation industry.

Hey! 👋

I'm Adolfo Güell, and every week, I spend countless hours selecting curated content—whether it's posts, news, or podcasts—centered around my passions: technology, macroeconomics, innovation, and more. This newsletter is my way of sharing the top-notch content I've come across.

I hope this weekly newsletter introduces you to exciting new content and talented creators.

If you have any questions or comments, don't hesitate to contact me at adolfoguelldmz@gmail.com.

My top picks 🔝

Sam Bankman-Fried was sentenced to 25 years for FTX fraud [TheVerge]. Summarizing the trial, it was stated that Bankman-Fried was aware of FTX's significant exposure to risk, understood that customer funds were not at his disposal, and was fully cognizant that his actions were illegal.

Interestingly, since some of SBF's investments have proved to be highly successful—like those in Anthropic and Solana—those who lost their funds will still be reimbursed.

The White House has released the budget for 2025 [White House], which has reached an All-Time-High in Government spending.

From a first principles perspective, why do Governments spend so much money and increase it over time? and what are the limits on taxing?

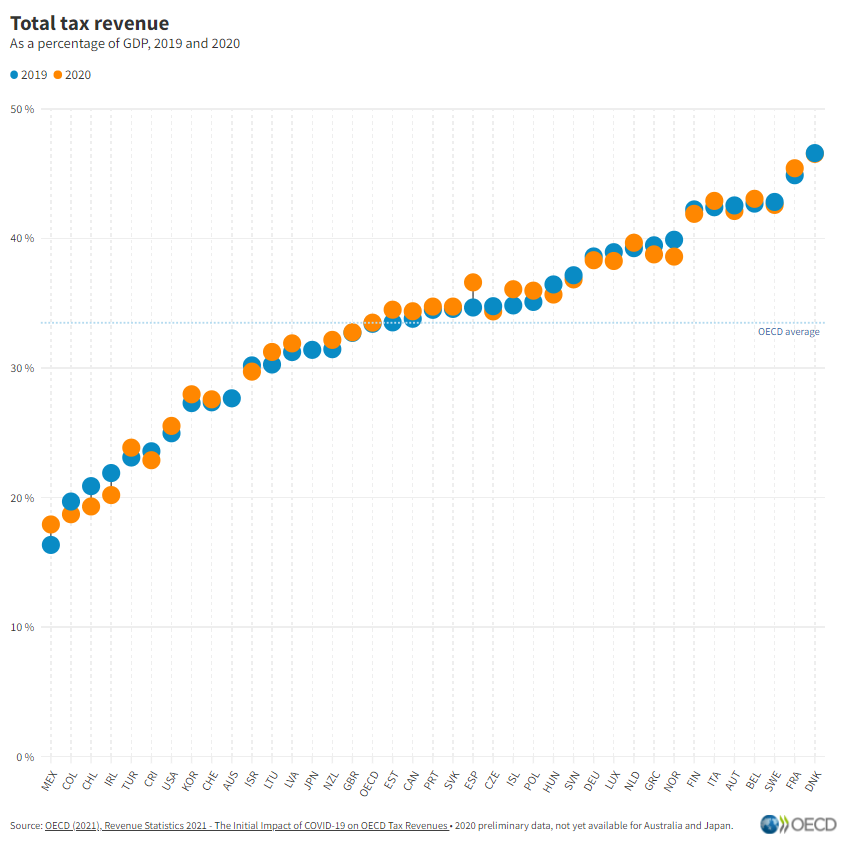

Some studies - like The Limits of Taxing the Rich by Brian Riedl - suggest that there is a maximum level of taxation without harming an economy, that is around 20% of the GDP. Whenever it is surpassed, there is a trend of the country’s GDP going negative, since the level of private investing in the country starts to decrease, and growth begins to shrink. Consequently, governments respond by injecting more funds into the economy, perpetuating a cycle.

Moreover, politicians, driven by the imperative to secure votes, are incentivized to offer more than their predecessors. Consequently, the government must finance this expanded investment, usually by boosting “revenue”. If the economy goes up, then Government’s revenue naturally increases, but if the economy does not increase, then the Government has two options:

Increasing revenue from taxes, which usually ends up in raising taxes.

Increasing debt, which also increases Government spending.

If this trend does not change, we should expect developed countries to increase spending in the following years, potentially resulting in both higher taxes and increased debt.

I’m also sharing a graph of total tax revenue per country [OECD], as a % of the GDP:

Credits: All-In Podcast Episode 172

This week I found this X thread [Andrew Côté on X] where it explains some facts about the aviation industry:

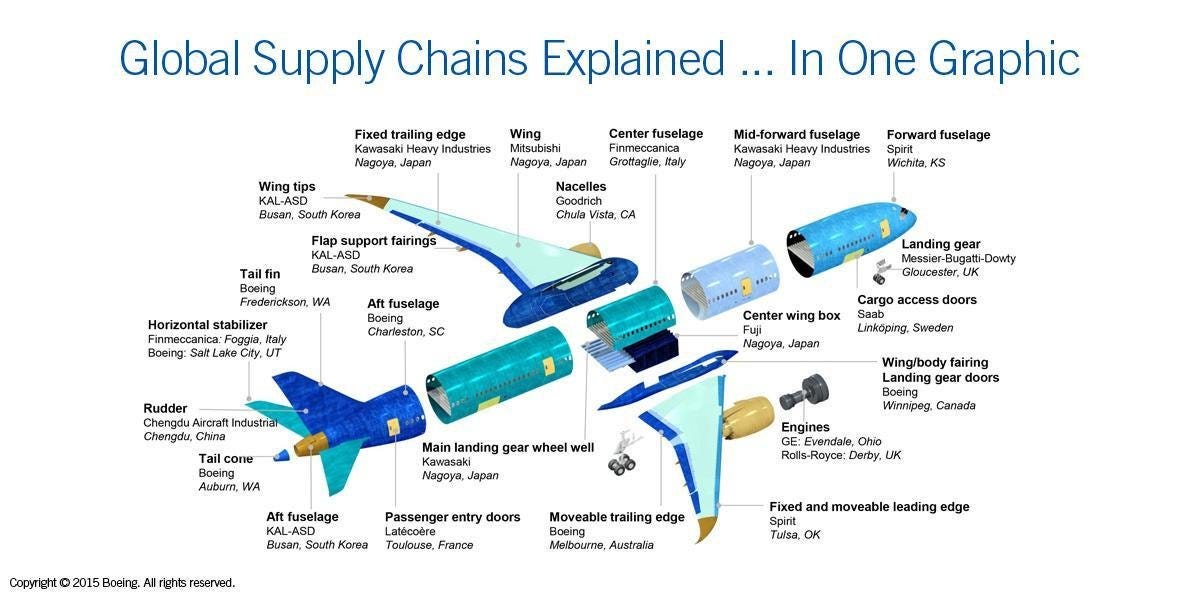

Traditional companies are horizontally integrated in order to generate cost efficiencies. However, this creates a situation were it’s harder to create altogether new products or techniques. Companies often innovate on cost-saving for small parts throughout the Global Supply Chain.

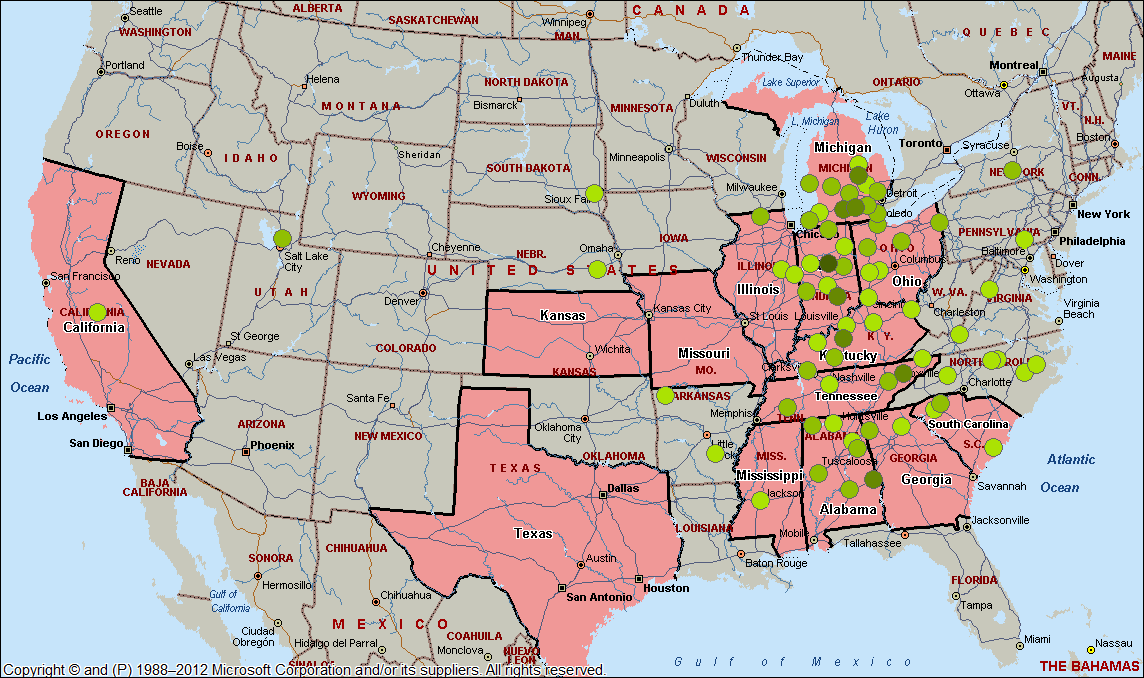

Operations are spread within a large number of different voting districts, mainly for voting capture. F.e. Boeing is the US Government’s 15th biggest donor with $14.5M in 2023 [Statista].

Traditional companies tend to use an outsourcing strategies, which often lead to overspending. F.e. “Boeing outsourced 70% of design, engineering, fab, and testing of the 787 Dreamliner”

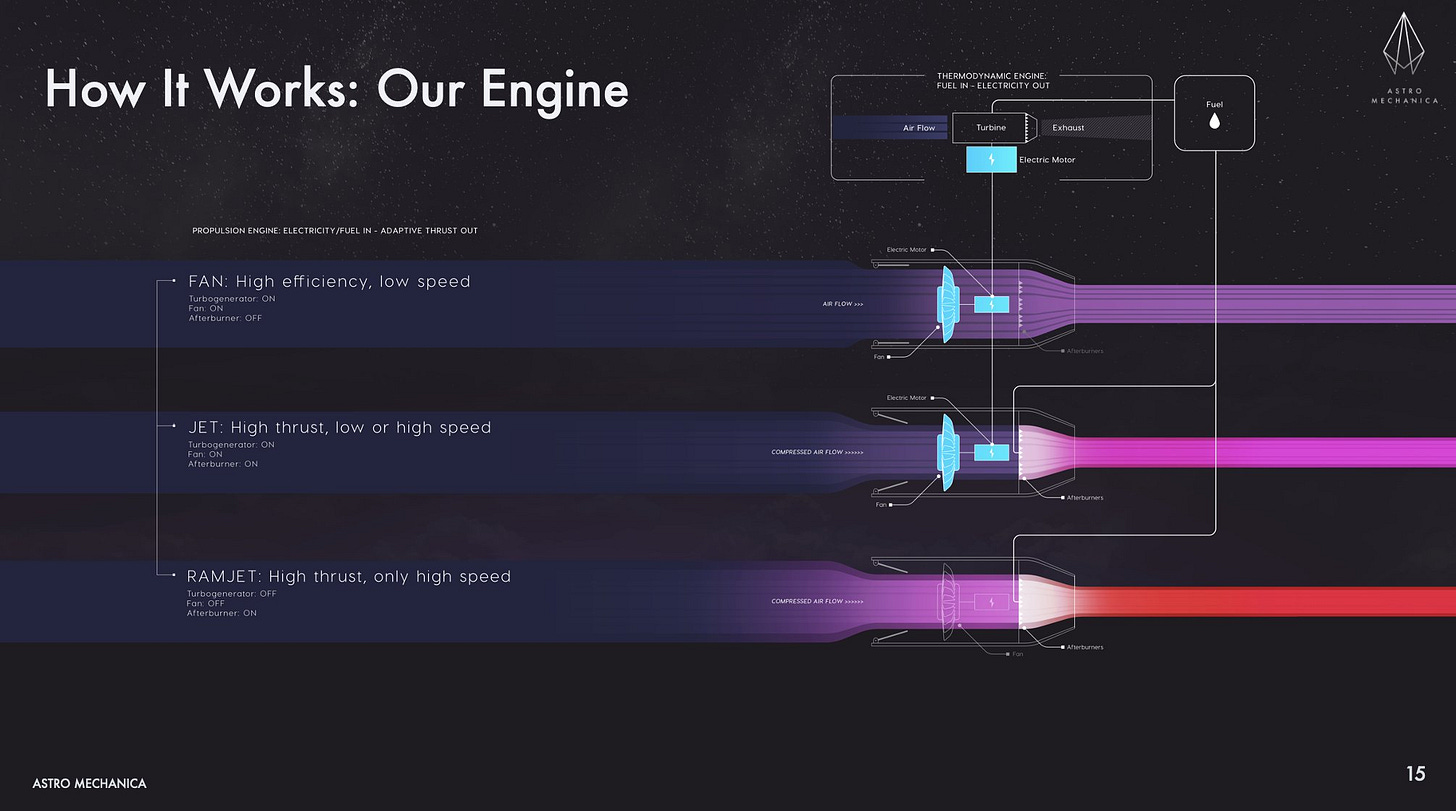

New companies are innovating by a completely vertical integration, which means creating new technologies from scratch. A new company, called Astro Mechanica is creating a new jet engine, which will make airplanes 3x faster using the same amount of fuel.

Larry Fink, the CEO of BlackRock, released its 2024 Annual Letter to Investors. I found it quite engaging as it primarily discusses the future of retirement amid increasing life expectancies. Despite significant efforts directed towards prolonging life expectancy, there's a notable absence of discourse on ensuring financial security for longer lifespans. The letter emphasizes the significance of capital markets in addressing this challenge, explores the potential adjustment of retirement age, and advocates for increased individual investment in retirement planning.

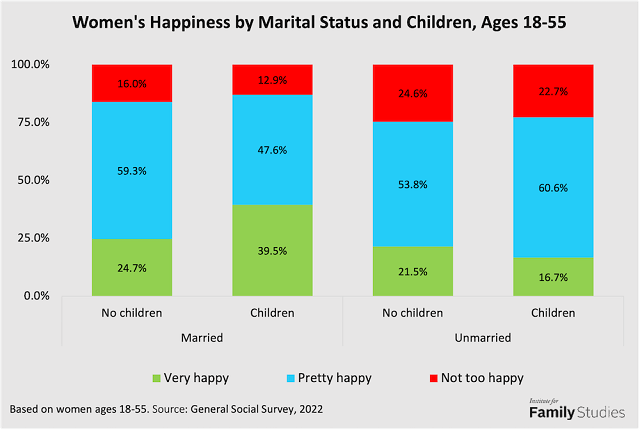

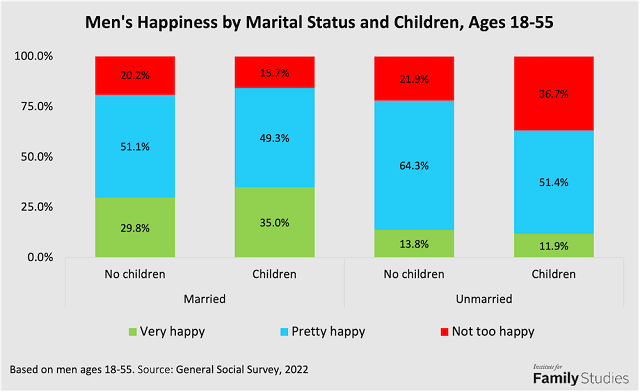

What impact does marriage and parenthood have on one's happiness? Recent findings from the General Social Survey (GSS) offer some compelling insights:

For women, marriage appears to correlate with increased happiness, with those who are married and have children reporting the highest levels of happiness.

Similarly, men generally experience the same trend. However, happiness levels seem to decline among men who have children but are not married.

Credits: Who Is Happiest? Married Mothers and Fathers, Per the Latest General Social Survey [Institute for Family Studies]

Some other reads I enjoyed…

In China: The 100-Year Storm on the Horizon and How the Five Big Forces Are Playing Out [Ray Dalio]

The UK Has Just Announced That It Is Imposing Sanctions On China [Mario Nawfal on X]

Ron DeSantis signs bill requiring parental consent for kids under 16 to hold social media accounts [TheVerge]

Adam Neumann Bids to Buy Back WeWork for More Than $500 Million [Wall Street Journal]

[VIDEO] Chamath's plan to return $1T from a $40B AI fund [All-In on X]

Bird flu discovered in U.S. dairy cows is ‘disturbing’ [Science]

Amazon Invests $2.75 Billion in AI Startup Anthropic [Bloomberg]

[VIDEO] Mustafa Suleyman: hallucinations by AI models are really the creativity that we have always wanted computer programs to produce [Tsarathustra on X]

🚀 Quick News by Volv

Read the top news from this week by Volv, 9 second news for high performing individuals: